Top Mental Wellness Tools for Stress Relief

1 year ago

Stress Relief Activities

How to Manage Bipolar Disorder Online: A Step-by-Step Guide

1 year ago

Bipolar Disorder

Research-Backed Tips to Manage Financial Stress

1 year ago

Managing Financial Stress

Understanding the Psychology of Compulsive Behaviors

1 year ago

Understanding Compulsive Behaviors

Exploring the Psychology Behind Brand Loyalty

1 year ago

Psychology of Brands

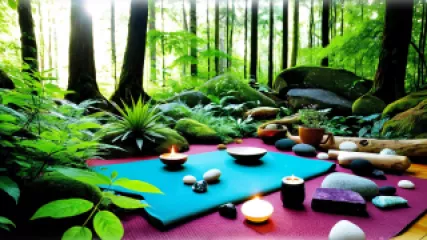

Exploring Alternative Therapies for Mental Health: A Research Summary

1 year ago

Alternative Therapies

Managing Bipolar Disorder: A Step-by-Step Guide

1 year ago

Bipolar Disorder

Exploring the Benefits of Alternative Therapies for Mental Wellness

1 year ago

Alternative Therapies

6 Steps to Unlock Your Creativity Through Virtual Therapy for Artists

1 year ago

Creative Therapy

My Journey to Overcome Financial Stress: A Personal Experience

1 year ago

Managing Financial Stress

The Science Behind the Psychology of Laughter: A Research Summary

1 year ago

Psychology of Laughter

Coping with Financial Stress: A Personal Perspective

1 year ago

Managing Financial Stress

The Ultimate Guide to Understanding Compulsive Behaviors

1 year ago

Understanding Compulsive Behaviors

How Virtual Counseling Can Help Build Stronger Brands

1 year ago

Psychology of Brands

Step-by-Step Guide to Managing Financial Stress

1 year ago

Managing Financial Stress